Cash Flow Management Sydney: The Lifeblood of Thriving Businesses

Introduction

In Sydney’s vibrant business landscape, cash flow management is essential for financial stability, operational continuity, and sustainable growth. Whether you run a small-to-medium enterprise (SME) in Parramatta or a startup in the CBD, cash flow is the fuel that keeps your operations running smoothly. This comprehensive guide explores the nuances of cash flow management Sydney, leveraging audience-specific insights, strategic perspectives, and cutting-edge platforms.

1. Audience: Who Needs Cash Flow Management Sydney?

Cash flow management Sydney is a critical practice tailored for various audiences across industries, each with unique financial needs:

Startups and Emerging Businesses

Sydney is home to a thriving entrepreneurial ecosystem. Startups face unique challenges, including fluctuating income, high initial expenses, and the need for investor trust. Robust cash flow management strategies help startups stabilise finances and scale sustainably.

Small-to-Medium Enterprises (SMEs)

With a significant number of SMEs in Sydney, challenges like late payments, seasonal demand fluctuations, and rising operational costs are common. Cash flow management provides SMEs with the foresight to navigate these hurdles and maintain consistent liquidity.

Corporations and Established Enterprises

For large corporations, effective cash flow management Sydney ensures the ability to invest in innovation, expand operations, and tackle market volatility.

Freelancers and Self-Employed Professionals

Independent professionals operating in Sydney, such as creatives and consultants, rely on streamlined cash flow management practices to maintain stability and predict revenue patterns.

Non-Profits and Community Organisations

Even non-profits in Sydney benefit from cash flow management by maximising resources and ensuring their ability to achieve mission-driven goals.

2. Perspective: Why Cash Flow Management is Vital

Cash flow management Sydney offers more than just financial oversight—it provides a strategic perspective that shapes businesses into resilient, adaptable entities.

Ensuring Operational Continuity

A steady cash flow enables businesses to cover essential operational costs, such as payroll, utility bills, and inventory purchases. This ensures day-to-day business activities continue uninterrupted.

Driving Strategic Decision-Making

Accurate cash flow forecasting equips businesses with the insight to make informed decisions. Whether planning an expansion or evaluating investment opportunities, understanding cash flow plays a pivotal role.

Navigating Sydney’s Economic Climate

Sydney, as a global economic hub, demands adaptability from businesses. Cash flow management allows organisations to thrive despite rising costs, regulatory changes, and market uncertainties.

Crisis Preparedness

Building reserves through proactive cash flow management protects Sydney businesses against unforeseen challenges, such as economic downturns or supply chain disruptions.

Aligning Financial Goals

By monitoring and analysing cash inflows and outflows, businesses in Sydney can align daily operations with long-term financial objectives, driving sustainable growth.

3. Platform: Tools and Technologies for Cash Flow Management Sydney

Modern tools and technologies play a vital role in facilitating effective cash flow management Sydney. Leveraging the right platforms ensures seamless tracking, forecasting, and optimisation of cash flow processes.

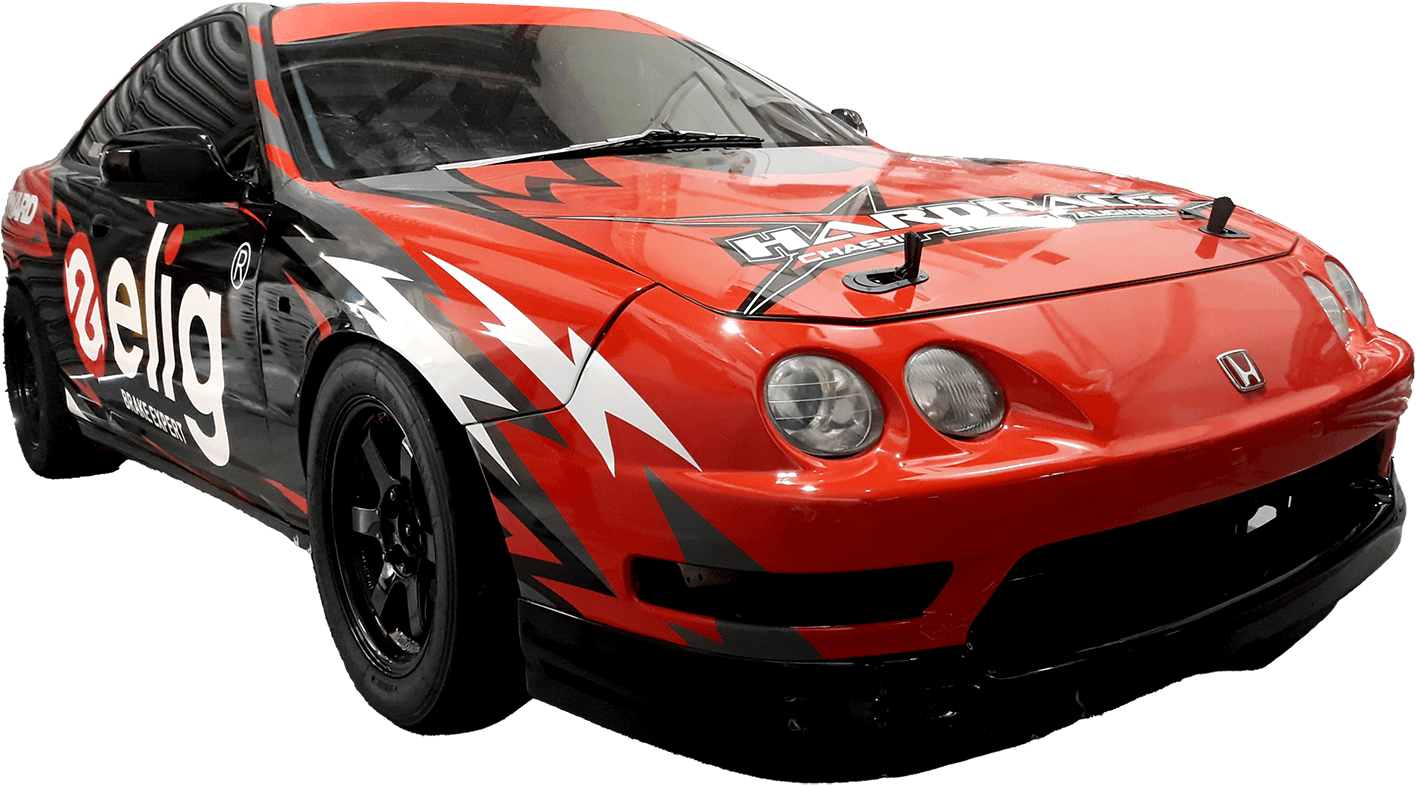

Our Expertise

- Signage

- Vehicle Branding

- Custom Stickers

- Corporate Services

- Motorsports

- All types of Custom Graphic Designs

From Sydney to Nationwide Customised Visual Experiences

- Strategically located in Central West Sydney

- Capable of serving clients nationwide

- Cater to diverse industries and sectors: Automotive, Retail, Hospitality and More

- Trusted partner for premium visual solutions

- Solutions leave a lasting impression

Our Clients

Accounting Software

Platforms like Xero and QuickBooks offer comprehensive solutions for financial tracking, invoicing, and analytics. They are widely popular among Sydney-based businesses for their reliability and ease of use.

Forecasting Tools

Cash flow projection tools like Float help businesses in Sydney predict cash flow patterns, enabling smarter decisions and reducing financial risks.

Payment Gateways

Seamless payment solutions such as Stripe, Square, and PayPal enable quicker customer transactions, reducing payment delays and improving cash inflows.

Collaborative Systems

Platforms like Slack and Microsoft Teams facilitate financial discussions among Sydney businesses’ teams, ensuring transparency and streamlined communication.

Inventory Management Software

Tools like Unleashed Inventory optimise stock levels, preventing over-investment in goods and improving cash flow alignment with sales.

Expanding Insights into Cash Flow Management Sydney

Cash Flow Challenges in Sydney

Sydney businesses face specific challenges, including:

- Seasonal Demand Fluctuations: Industries such as tourism and hospitality experience revenue peaks and troughs based on seasons.

- Rising Costs: High property rents, wages, and operational expenses in Sydney impact profit margins.

- Late Payments: Customer payment delays disrupt cash flow stability and planning.

Strategies for Effective Cash Flow Management

- Automate Invoicing: Reduce the risk of late payments by using automated invoicing systems.

- Monitor Cash Flow Regularly: Implement daily or weekly cash flow reviews to identify issues early.

- Build an Emergency Fund: Safeguard against revenue shortfalls with reserved funds.

- Negotiate Supplier Terms: Align payment deadlines with cash inflows to optimise liquidity.

Real-Life Success Stories

- Retail Store in Paddington: Leveraged forecasting tools to streamline inventory purchases, reducing costs and stabilising cash flow.

- Tech Startup in Surry Hills: Implemented automated invoicing, reducing overdue payments by 40% and improving financial predictability.

in Action

financial stability, forecasting, liquidity optimisation, revenue management, and payment solutions enriches the blog for SEO and reader engagement.

In the bustling environment of Sydney, cash flow management is indispensable for businesses seeking stability and growth. Whether you’re an SME, a startup, or a corporation, implementing robust cash flow management practices ensures resilience and success in a competitive market. Leverage the strategies, perspectives, and platforms shared in this guide to master cash flow management Sydney and pave the way for your financial excellence.